Tips for Opening a Company in Hong Kong

Hong Kong is considered one of the world’s leading financial centers, with an open and business-friendly economic system. Thanks to low taxation, easy access to the Chinese market, and a simple regulatory system, opening a company in Hong Kong can be a smart business move. Here are key tips for successfully opening a company:

Choose the Appropriate Company Type

- Prefer Private Limited Company: This structure provides legal protection for shareholders, the ability to raise capital, and low taxation.

- Ensure the business structure suits your needs, especially if you’re planning international activities.

Choose a Unique Company Name

- Ensure the name is unique and different from other companies registered in Hong Kong.

- You can choose a name in English, Chinese, or a combination of both languages.

- Use the Companies Registry database to check name availability.

Submit Documents Correctly

- Prepare Form NNC1 and Articles of Association, which define company rules.

- Ensure you’ve appointed at least one director (can be a foreign citizen), a Hong Kong resident company secretary, and a registered address. Tip: Use professional consultants for accurate and quick document completion and submission.

Open a Business Bank Account in Hong Kong

- Bring incorporation documents, shareholder information, and a detailed business plan.

- This process may take time, so plan ahead. Tip: Many consulting firms can help find a suitable bank and assist with the opening process.

Tax Registration

- Register the company with the local tax authority (IRD) and obtain a Business Registration Certificate (BRC).

- If the company operates only outside Hong Kong, you can enjoy tax exemption on foreign income.

Ongoing Regulatory Compliance

- Submit annual returns to the Companies Registry and update business details as needed.

- Ensure submission of audited financial reports to tax authorities. Tip: Maintain a clear timeline for all submissions to avoid penalties.

Use Professional Third-Party Service

Why is it recommended?

- Company Incorporation: Services including document completion and submission.

- Company Secretary: Managing board meetings, legal compliance, and report handling.

- Address and Mail Services: Using an official address for official correspondence.

- Tax and Accounting Consultation: Bookkeeping, local and international tax advice, and report submission.

- Legal Assistance: Help with contract drafting and complex legal matters. Tip: Choose an experienced and recognized company that provides services tailored to your business needs.

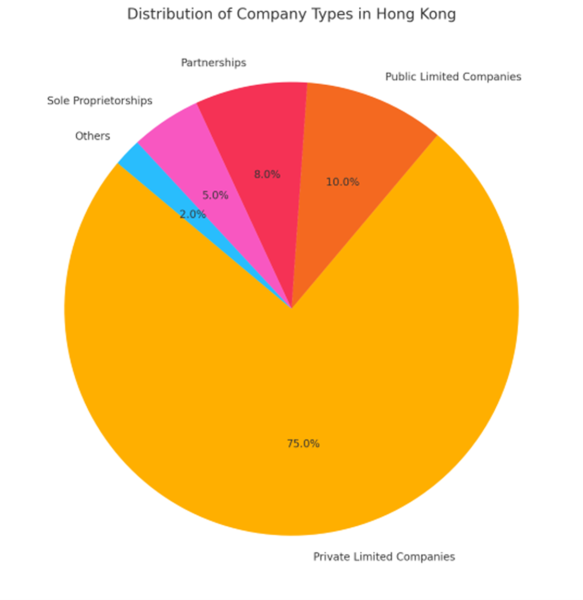

Distribution of Company Types in Hong Kong Hong Kong has a diverse distribution of company types. Below is a graph showing the distribution of registered companies:

Private limited companies are the most common type, due to their legal and tax advantages.

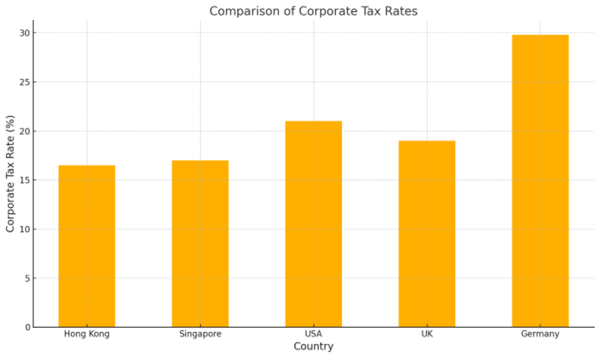

Comparison of Corporate Tax Rates

Hong Kong enjoys a particularly competitive corporate tax rate compared to other countries. Below is a graph comparing tax rates in Hong Kong versus other countries like Singapore, USA, UK, and Germany:

- Hong Kong: 16.5%

- Singapore: 17.0%

- USA: 21.0%

- UK: 19.0%

- Germany: 29.8% As can be seen, Hong Kong’s low tax rate represents a significant advantage for international entrepreneurs and investors.

Key Advantages of Opening a Company in Hong Kong

- Attractive Taxation: Low corporate tax (8.25%-16.5%) and exemption on foreign income.

- Access to Chinese and International Markets: Hong Kong is a leading business gateway to Asia.

- Legal and Economic Stability: System based on British law.

- Ease for Foreign Businesses: No restrictions on foreign citizens in roles such as directors or shareholders.

Summary

Opening a company in Hong Kong is a smart business decision that offers many opportunities. Maintaining compliance with legal requirements, proper planning, and using third-party services can ensure your company operates smoothly. If you’re considering establishing a company, it’s recommended to consult with experts to streamline the process.